Over the last few months, APSCo (Association of Professional Staffing Companies) have monitored hiring activity in London, specifically analysing new professional vacancies with salaries £40k per annum or more.

This gives us an indication of where vacancy growth is occurring during the Coronavirus pandemic. From their analysis of hiring activity from the past month, (APSCo COVID-19 London Vacancy Tracker – June 2020) they see these following trends emerge:

- While there has been a small increase in recruitment activity in May (1.8%), overall the daily volumes month on month have not changed by a significant amount.

- In comparison to the first quarter of this year, where the daily average was over 500 job openings, activity is still significantly down.

- In terms of the five-day rolling average, May 4 was the lowest point, with a total of 165 professional vacancies. Since then, there has been a gradual uptick, with a record day in May of 307 professional vacancies – the highest number of job openings since the crisis started.

- As APSCo mentioned in previous reports, the Technology sector has been one of the least impacted areas, although even here, hiring activity dropped in May by 2.9% compared to April.

- In contrast, the two best performing sectors in terms of month on month increases were Consumer Goods & Services (+32%) and Real Estate & Construction (+33.5%). These increases will be a relief to policy makers, given how important they are for the UK economy.

- Other sectors which are significant to London’s economy include Insurance, along with Accounting & Consulting. The good news for recruiters is that activity in both areas has picked up sharply, increasing by 17% and 12% respectively.

According to the REC and KPMG’s report on jobs for the South East of England

- Staff Appointment adjusted for seasonal factors, the Permanent Placements Index signalled a third successive monthly drop in the number of people placed into permanent jobs in the South of England during May. The rate of contraction eased only slightly from April’s record pace and was the second-quickest since the survey began in October 1997. That said, the reduction was softer than the UK-wide trend.

- Recruitment consultancies based in the South of England signalled a further steep reduction in billings received from the employment of short-term staff in May. Notably, the rate of reduction was substantial and exceeded only by April. A considerable drop in temp billings was also seen at the UK level, albeit one that was not quite as severe as that seen in the South of England. According to recruiters, company closures and economic uncertainty weighed on billings.

- Permanent vacancies continued to decline at a considerable pace in May, despite the rate of contraction easing from April’s series record. Demand for permanent workers also fell at the national level, and at a slightly faster rate than in the South of England.

- Short-term vacancies also declined sharply midway through the second quarter. Although softer than that seen in April, the fall was nonetheless the second-fastest on record. Temp vacancies fell at a similarly sharp rate across the UK as a whole.

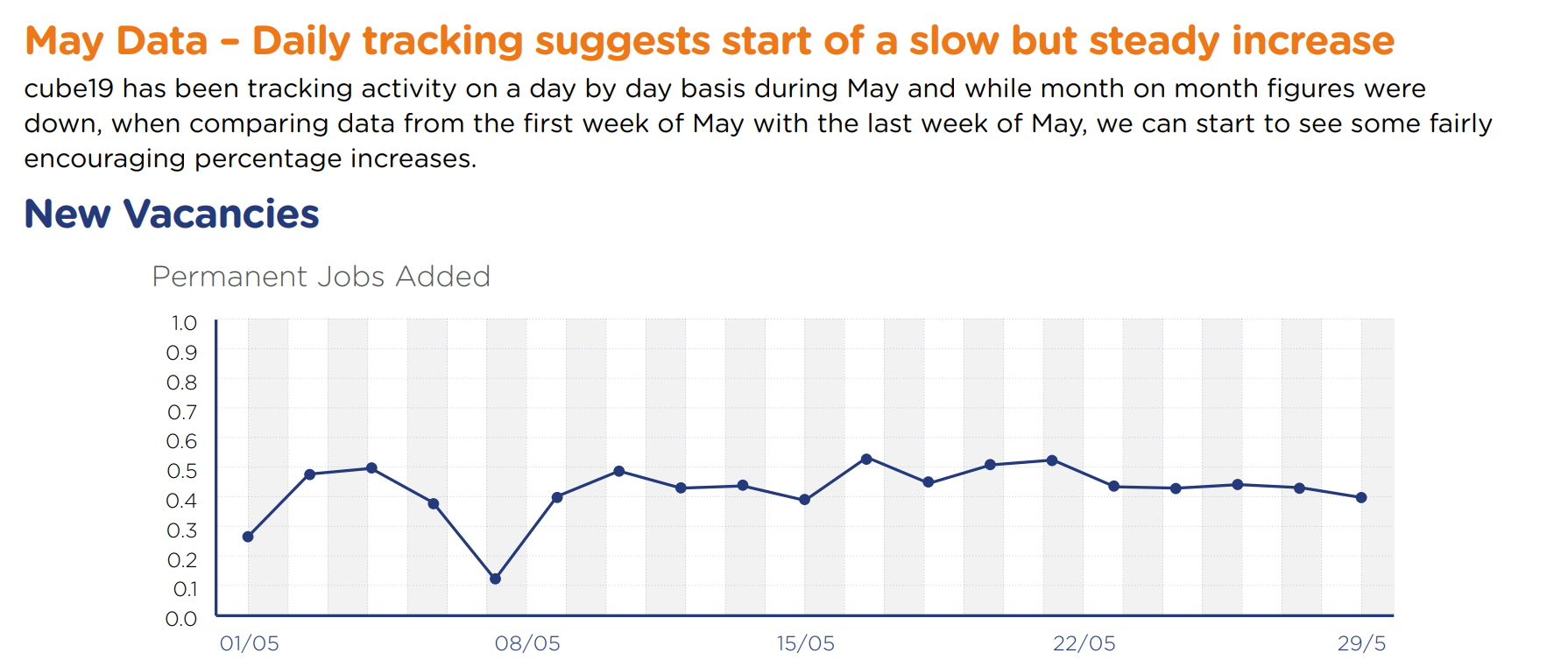

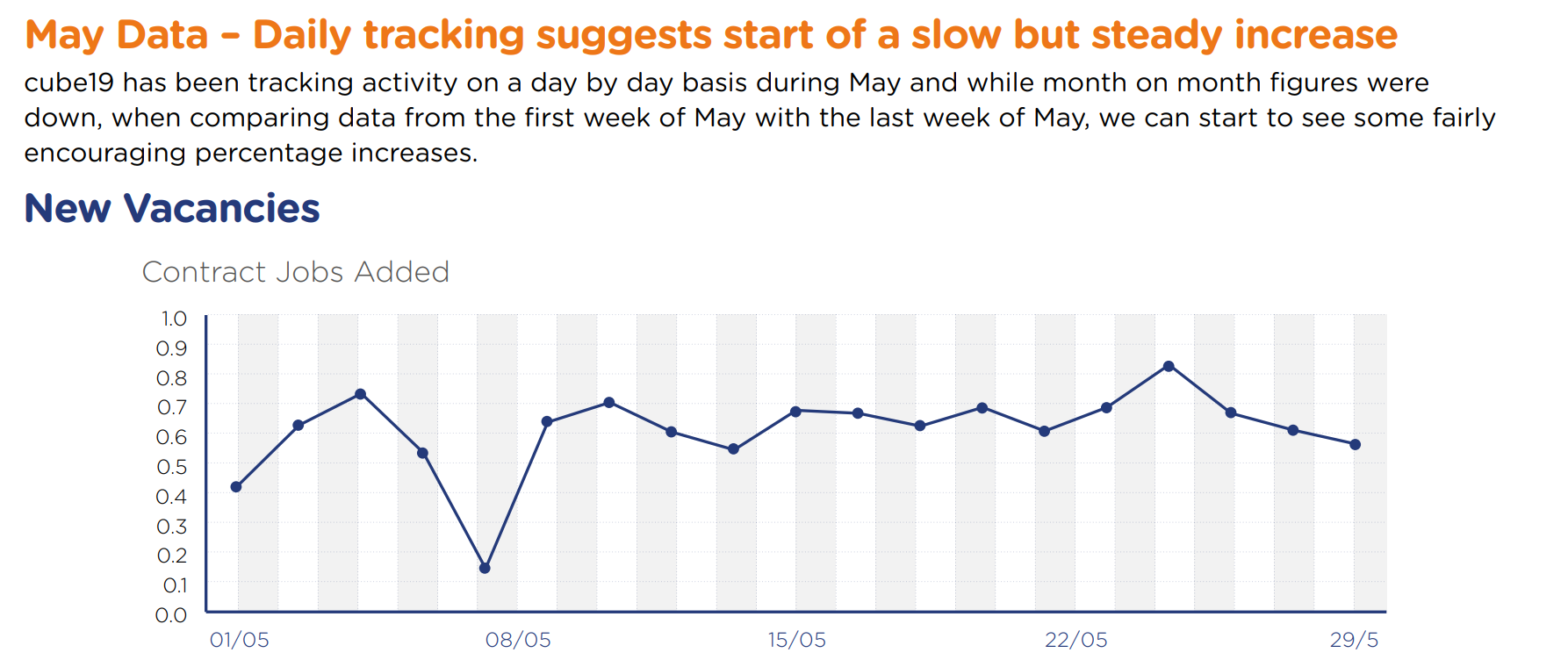

In addition, APSCo’s latest June Recruitment Trends Snapshot (powered by cube19) shows slow but steady signs of improvement during the month of May, which we hope is the start of small steps forward as more and more businesses plan their return.

Although the latest recruitment data does make for uncomfortable reading, and clearly there is still nervousness among the workforce when it comes to returning to the workplace, there are some glimmers of hope on the horizon. As a total workforce management company, working across multiple sectors, planning and communication remains the vital elements to a successful return to the workplace, whether that is with the reengagement of the existing workforce or the hiring of new personnel. All businesses across the UK need to carefully plan the legal and logistical challenges as we exit lockdown.